There is an infrequently-used mortgage program available that could help with a buyer's financing challenges.

2/1 temporary buydown is a fixed-rate mortgage where, at closing, the seller prepays interest to lower the payments over two years. The borrower must qualify at the note rate but will have lower payments for the first part of their mortgage term.

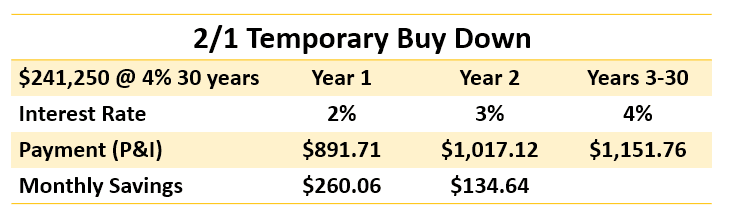

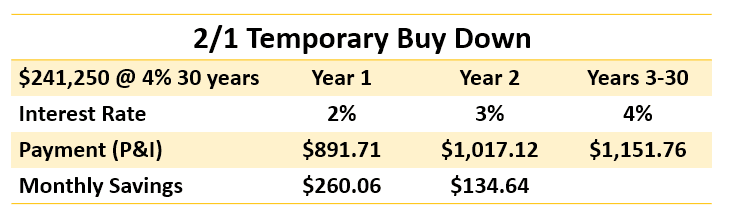

With a 2/1 buydown, the first 12 payments (year 1) are calculated at 2% lower than the buyer's note rate, and the next 12 months (year 2) payments are calculated at 1% lower than the buyer's rate. Then, the rest of the payments (28 years) payments are calculated at the note rate.

For example, a buyer has cash for a down payment and closing costs to buy the property. They'd like to make some changes to personalize the home when they move in, but they used their cash.

Let's say the buyer purchased a $250,000 home with a 3.5% down payment and a 4% 30-year, fixed-rate mortgage. Typically, the principal and interest payment would be $1,151.76 for the 30-year length of the mortgage. But, if the seller pays the buyer's lender $4,736 at closing, they can apply it to their first two years of interest payments.

In this scenario, the buyer's P&I payment during the first year will be $891.71/month - based on a 2% interest rate (2% less than their 4% rate). That saves them $260.06 per month during the first 12 months. During the next 12 months (year 2), their payment will be $1,017.12 - based on a 3% interest rate (1% less than the 4% interest rate). So, they are then saving $134.64 per month.

Plus, the cost of the buydown paid at closing by the seller is tax-deductible (by the buyer) during the purchase year. The buyer reduced payments for two years and a tax deduction.

Sellers can consider offering a 2/1 buy down to improve financing terms instead of reducing the home's price. It's essential that agents and potential buyers are aware of and understand the program.